The $2.9 Million Reality: How Data Fragmentation Is Reshaping Workers’ Compensation Strategy

Recent industry analysis reveals that organizations with fragmented workers’ compensation systems experience cumulative annual losses of 3-5% of their total workers’ comp expenses—translating to $30,000-$50,000 in unnecessary costs for mid-market companies with $10 million payrolls.(10) More concerning is the 15-20% year-over-year increase in audit fees, driven not by regulatory complexity, but by operational inefficiency.

The transformation opportunity is substantial. Companies implementing integrated data pipelines report 40-50% operational efficiency improvements, with audit processing times decreasing from three weeks to one day.(3) This article examines how intelligent data architecture is revolutionizing workers’ compensation management, providing mid-market leaders with a roadmap for competitive advantage through operational excellence.

What You’ll Discover

- The true cost of system fragmentation beyond direct audit expenses

- How AI-powered audit stacks eliminate traditional bottlenecks

- Practical implementation strategies for sustainable transformation

- Measurable ROI frameworks for data pipeline investments

Understanding the Fragmentation Challenge

The Anatomy of Operational Disconnect

Traditional workers’ compensation environments operate through three isolated data ecosystems, each creating distinct operational barriers that compound audit complexity and increase financial exposure.

Payroll System Isolation creates the foundation for audit inefficiency. HR systems maintain employee wage data in proprietary formats, requiring manual extraction that introduces 14% error rates into audit processes.(4) These errors cascade through premium calculations, often resulting in 30% premium miscalculations that surprise organizations during audit finalization.

The manual extraction process consumes 40 hours weekly of administrative resources, transforming routine data collection into a resource-intensive operation. Payroll categories frequently become outdated or misaligned with actual job functions, creating classification discrepancies that auditors must reconcile through time-consuming verification processes.

Claims Processing Separation compounds operational challenges by isolating critical injury and settlement data from payroll and policy information. Medical provider networks, injury reports, and settlement details reside in independent databases without cross-reference capabilities.

This isolation prevents organizations from identifying predictive patterns that could reduce claim severity by 25%.(5) The absence of integrated claims data eliminates opportunities for proactive interventions, forcing organizations into reactive management approaches that increase both frequency and severity of workers’ compensation incidents.

Policy Management Disconnection creates the final barrier to operational efficiency. Coverage details, classification codes, and risk assessments operate independently from operational claims and payroll systems.

This disconnection makes real-time coverage validation impossible, leaving organizations exposed to protection gaps that can result in significant financial liability during serious workplace incidents. Companies frequently discover classification errors only during audits, resulting in unexpected premium adjustments that disrupt cash flow and budget planning.

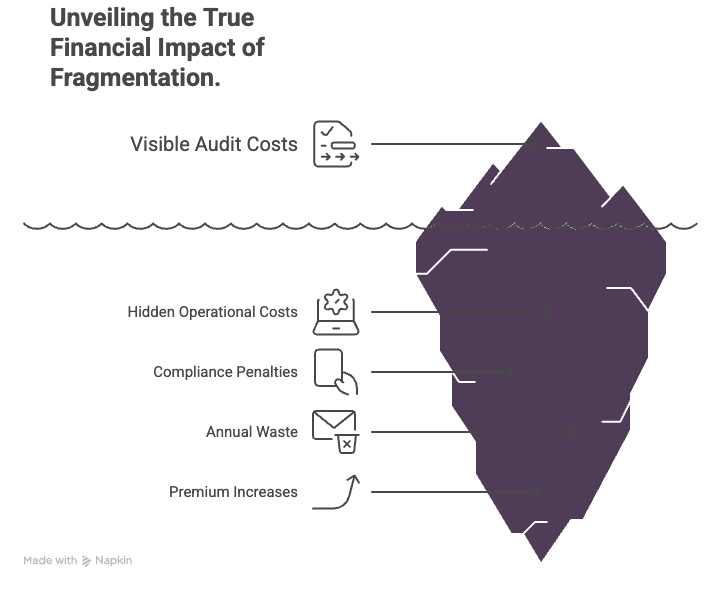

Quantifying the Financial Impact

The economic implications extend far beyond operational inefficiencies, creating cascading costs that affect organizational competitiveness and financial stability

Direct Audit Costs consume $2,000-$5,000 per audit cycle in manual data collection and reconciliation activities.(7) This expenditure includes administrative time for documentation assembly, interdepartmental coordination, and external auditor fees. Manual processes extend audit duration, increasing both labor costs and operational disruption periods

Premium miscalculations resulting from fragmented data create unexpected audit adjustments of 15-30%, generating cash flow disruptions and budget variance that affects quarterly financial performance.

Hidden Operational Costs add 25-40% to direct system expenses through resource allocation inefficiencies.(8) Fragmented systems require dedicated personnel for data integration, multiple software licenses, and extensive interdepartmental coordination.

High error remediation rates consume additional resources, as organizations must invest time correcting discrepancies discovered after audit completion. The opportunity cost of foregone data-driven insights accumulates year-over-year, preventing organizations from optimizing workers’ compensation performance.

Compliance and Risk Penalties represent the most severe financial exposure. Fragmented systems complicate continuous compliance monitoring, leading to violations that can result in fines ranging from $10,000-$100,000 per incident.(9)

Inadequate integrated data increases coverage gap probability, exposing organizations to liability during serious workplace injuries. Poor claims management can increase experience modification factors by 0.2-0.5 points, resulting in 20-50% premium increases that persist for multiple policy periods.

The AI-Powered Solution Architecture

Unified Data Integration: Breaking Down Silos

Modern audit stack architecture leverages AI-powered data pipelines to eliminate traditional bottlenecks through automated data collection, validation, and aggregation processes.

Real-Time Synchronization connects payroll, claims, and policy management systems through centralized data lakes, eliminating batch processing delays that create audit timing challenges. Data flows continuously into unified repositories, ensuring audit teams access current information without manual data gathering.

Automated Compliance Monitoring employs AI algorithms to identify regulatory violations and missing data classifications through real-time inspection of incoming data streams. Machine learning models automatically categorize transactions and flag potential compliance issues before they become audit findings.

Predictive Analytics Capabilities utilize historical audit patterns to forecast premium adjustments and identify high-risk classifications before audit submission. These models enable proactive corrections that prevent unexpected audit outcomes and optimize premium accuracy.

Standardized Data Formats eliminate reconciliation errors by 45% through unified data schemas that normalize information from disparate source systems.(13) Consistent formatting reduces manual verification requirements and accelerates audit completion timelines.

Operational Efficiency Transformation

The transition to AI-powered audit systems fundamentally changes operational dynamics, shifting resources from manual processing to strategic analysis and risk management.

Organizations implementing integrated systems report 60% reduction in audit cycle times and 25% decrease in total audit expenses within the first implementation year.(14) Manual reconciliation efforts decrease from 40 hours weekly to 12 hours, freeing resources for value-added activities.

Performance Comparison: Manual vs. AI-Powered Systems

| Metric | Manual Stack | AI-Powered Stack | Improvement |

| Audit Cycle Time | 10-15 days | 4-6 days | 60% reduction |

| Data Reconciliation Errors | 14% error rate | 7% error rate | 50% improvement |

| Annual Audit Costs | $2,000-$5,000 | $1,500-$3,000 | 25-40% reduction |

| Compliance Violations | 4-6 per year | 1-2 per year | 67% reduction |

Advanced Pattern Recognition and Risk Management

Intelligent Anomaly Detection

Machine learning-based systems analyze 100% of transaction data in real-time, compared to traditional audit sampling of 2-5% of records.(15) Autoencoder networks establish baseline patterns for payroll records, automatically flagging reconstruction errors that indicate potential misclassification or data integrity issues.

This comprehensive approach reduces false positives by 60% compared to static rule-based checking systems, allowing audit teams to focus on genuine discrepancies rather than benign variations.(16)

Continuous Monitoring Advantages

Real-time risk assessment provides immediate visibility into emerging compliance variances, enabling mid-course corrections before audit finalization. Machine learning models predict audit outcomes and automatically correct data inconsistencies, while automated alert systems replace manual report generation with instant notifications.

Measurable Impact of Automation

| Benefit Category | Impact Metric | Improvement |

| Cost Reduction | Annual audit expense | 35% decrease |

| Accuracy Improvement | False positive alerts | 60% reduction |

| Financial Stability | Unexpected premium changes | 71% reduction |

| Data Quality | Pipeline output accuracy | 45% improvement |

Organizations achieve these improvements while reducing error correction expenditure by 30%, with automated compliance checks preventing regulatory fines averaging $50,000 per incident.(19)

Strategic Implementation Framework

Phased Transformation Approach

Successful implementation requires systematic approach that minimizes operational disruption while delivering measurable value at each milestone.

Phase 1: System Architecture Assessment Map existing workers’ compensation systems, data sources, and processes through stakeholder workshops. Document current process flows for payroll, claims, and policy management while identifying integration gaps and compliance vulnerabilities.

Phase 2: Custom Pipeline Design Develop cloud-native architecture supporting both real-time and batch data ingestion. Implement infrastructure-as-code practices using Terraform or CloudFormation for version control and audit pipeline components.

Phase 3: Iterative Implementation Deploy pipeline components in controlled sprints to avoid operational disruption. Conduct sprint reviews to refine scope based on user feedback and evolving regulatory requirements.

Phase 4: Performance Optimization Establish service level indicators (SLIs) and objectives (SLOs) for data freshness, error rates, and processing latency. Integrate monitoring tools with automated detection of schema drift and ingestion errors.

Phase 5: Knowledge Transfer Provide role-based training for internal staff on pipeline operation and maintenance. Establish documentation and support processes for sustainable operation.

Expected ROI and Performance Metrics

Organizations implementing comprehensive data pipeline solutions achieve measurable improvements across multiple operational dimensions:

| Outcome Metric | Baseline (Manual) | Post-Implementation | Improvement |

| Audit Cycle Time | 10-15 days | 4-6 days | 60% reduction |

| Manual Reconciliation | 40 hours/week | 12 hours/week | 70% reduction |

| Premium Accuracy | 85% | 95% | 10% improvement |

| Compliance Violations | 4-6 per year | 1-2 per year | 60% reduction |

| ROI Payback Period | N/A | Under 9 months | Rapid value realization |

Competitive Advantage Through Digital Excellence

The transformation from fragmented to fluid workers’ compensation operations represents more than operational improvement—it creates sustainable competitive advantage through enhanced risk management, regulatory compliance, and financial predictability.

Organizations that successfully implement integrated audit stacks position themselves for scalable growth without proportional increases in administrative overhead. Cloud-based data pipelines provide on-demand computing resources that automatically scale with data volumes, enabling companies to handle 300% increases in audit workloads without infrastructure expansion.(20)

The strategic value extends beyond cost reduction to include improved decision-making capabilities, enhanced regulatory relationships, and competitive positioning in increasingly regulated markets. Companies with fluid audit operations can respond more quickly to regulatory changes, optimize insurance procurement strategies, and demonstrate operational excellence to stakeholders.

The Path Forward

The evolution from fragmented to fluid workers’ compensation operations is not a technology transformation—it’s a strategic imperative for mid-market organizations seeking sustainable competitive advantage. The question is not whether to implement intelligent data pipelines, but how quickly organizations can realize the operational and financial benefits of integrated audit systems.

Success requires partnership with experienced implementation teams who understand both the technical complexity of data integration and the operational realities of workers’ compensation management. The organizations that act decisively will establish operational advantages that compound over time, while those that delay face increasing costs and competitive disadvantage in an evolving regulatory environment.